Tax Checkoff

This tax season, do something special for the 9,000+ Special Olympics athletes in the state by selecting Special Olympics Wisconsin on your state tax return.

As a fan of Special Olympics, you have likely witnessed the power of the mission. Special Olympics is transformative – not just for individuals with intellectual disabilities (ID), but for everyone involved. For over 50 years, Special Olympics has been building a movement to break down barriers for individuals with ID through the power of sport. Yet the movement is so much more than sports. Together, we are creating an #InclusionRevolution based on acceptance and respect.

Make a gift, change a life.

- $15 Gift some tennis balls at the State Tournament

- $25 Give a team a basketball for a unified competition

- $50 Provide medical equipment for free health screenings

- $100 Donate to support school-based inclusion and education for all abilities

Your Impact

- Special Olympics Wisconsin is a 501(c)(3) charitable organization supported almost entirely through generous contributions from individuals, organizations, businesses and foundations

- The cost to support one athlete for one year is nearing $900

- 100% of donation stays in Wisconsin to benefit the athletes of Special Olympics Wisconsin

Follow these 3 easy steps to donate:

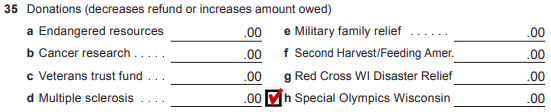

![]() Locate the section called “Donations” on either the electronic or paper form

Locate the section called “Donations” on either the electronic or paper form

![]() Select Special Olympics Wisconsin

Select Special Olympics Wisconsin

![]() Indicate the amount you would like to donate

Indicate the amount you would like to donate

If you use a tax preparer, let them know how much you would like to contribute.

By making a donation, you will make a real and tangible difference in the lives of children and adults with intellectual disabilities. And, with your help, we can reach even more athletes this year and beyond!